23 Mar What is the Average Cost Of Life Insurance Per Month?

What is the Average Cost Of Life Insurance Per Month?

- Life insurance protects your family financially

- Can provide you with peace of mind

- Life Insurance starting from £6* a month

- Long term and short term cover

Evaluating Your Coverage Needs

Life insurance is important for anyone who wants to ensure their loved ones are financially secure in the event of their death. However, many people are hesitant to purchase a policy due to concerns about the cost. In this article, we’ll explore the average cost of life insurance and provide tips to find the right policy to fit your budget and needs.

Before you can determine the average cost of life insurance per month, you need to evaluate your coverage needs. Consider factors such as your age, health, income, and the financial needs of your dependents. We make sure to calculate exaclty what our clients need in place for their individual circumstances. The advice and quotes that we give to our clients is tailored to their specific needs.

Keep in mind that the average cost of life insurance per month will vary depending on factors such as your age, health, and the type of policy you choose.

The amount of coverage you need will depend on your individual circumstances. For example, if you have young children who depend on your income, you may need more coverage than someone who is single and has no dependents. Similarly, if you have a mortgage or other debts, you may need more coverage to ensure that those debts can be paid off in the event of your death.

Choosing the Right Type of Life Insurance Policy

When it comes to choosing a life insurance policy, there are two main types to consider: term life insurance and whole of life insurance. Term life insurance provides coverage for a specific period of time, and is generally less expensive than whole of life insurance. Whole of life insurance, on the other hand, provides coverage for the duration of your life and can also serve as a funeral benefit. It’s important to consider your individual needs and budget when choosing the right type of policy for you.

The cost of life insurance can vary greatly depending on a number of factors, including age, health, and the type of policy you choose. On average, a term life insurance policy can cost anywhere from £6 per month for a healthy individual in their 20s or 30s. However, the cost can increase significantly as you age or if you have pre-existing health conditions. Whole of life insurance policies tend to be slightly more expensive. We work with 5 star defaqto companies, so we are able to compare quotes from different insurance providers to find the best policy and price for your individual needs.

Understanding the Factors that Affect Life Insurance Costs.

The cost of life insurance can vary widely depending on a number of factors. These include your age, health, occupation, hobbies, and lifestyle habits such as smoking or drinking. Additionally, the type and amount of coverage you choose will also impact the cost of your policy.

Age

Age is one of the most significant factors that insurers consider when calculating life insurance premiums. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered to be at a lower risk of developing health issues or passing away prematurely. As you age, the likelihood of health issues increases, resulting in higher premiums.

Health and Lifestyle Factors

Your health and lifestyle choices play a crucial role in determining the cost of your life insurance. Factors such as smoking, excessive alcohol consumption, obesity, and pre-existing medical conditions can result in higher premiums. On the other hand, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can potentially lower your premiums.

Occupation

Your occupation can also impact the cost of your life insurance. Certain occupations are considered riskier than others, and insurers take this into account when calculating premiums. For example, individuals working in high-risk professions such as mining or aviation may face higher premiums due to the increased likelihood of accidents or health issues related to their occupation. On the other hand, individuals working in low-risk professions may enjoy lower premiums.

Coverage Amount

The coverage amount you choose for your life insurance policy can also impact the cost of your premiums. Generally, the higher the coverage amount, the higher your premiums will be. This is because a higher coverage amount means a higher potential payout for the insurer in the event of your death. It’s important to strike a balance between the coverage you need and what you can afford in order to ensure that you are adequately protected without overpaying for unnecessary coverage.

How Can You Reduce Your Premiums?

We often get asked the question, How can I lower my premiums?’ Lowering monthly life insurance premiums can be achieved through several strategies. Firstly, maintaining a healthy lifestyle is crucial. Regular exercise, a balanced diet, and avoiding risky habits like smoking or excessive drinking can significantly reduce premiums. This is because the healthier you are, the less of a risk you are to the insurance company.

Another way is by choosing a term life insurance policy instead of a whole of life policy, as term policies tend to have cheaper premiums. Whole of life policies guarantee you a payout no matter when you pass away, which is why they are more expensive.

Comparing insurance quotes from various providers is also essential. By obtaining multiple quotes, individuals can determine the most cost-effective options that meet their requirements. We work with a number of 5 star defaqto life insurance providers, which means that when we provide clients with quotes, we compare each provider to ensure that the client receives the most affordable and comprehensive coverage available.

Additionally, reviewing your life insurance policy every so often may help lower your premiums. By implementing these strategies, individuals can effectively decrease their monthly life insurance premiums and enjoy financial peace of mind.

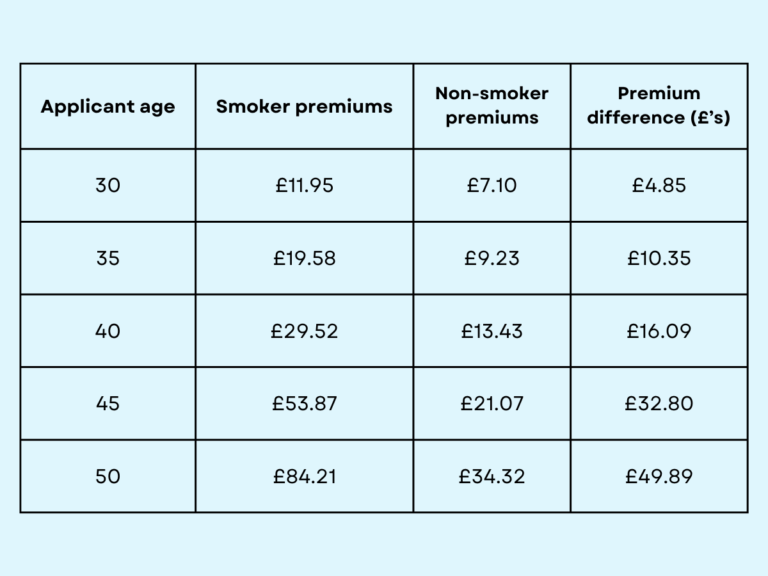

Average cost of cover for a smoker

Individuals who smoke or use nicotine-based products, including vapes and patches, should expect higher life insurance premiums compared to non-smokers.

The average cost of life insurance for smokers rises with age due to increased mortality risks, primarily linked to conditions such as lung cancer. Extensive research has established the direct correlation between smoking and lung cancer, heightening the likelihood of life insurance and critical illness insurance claims for smokers.

Moreover, the risk assessment now extends beyond smoking to include nicotine usage. This broadens the category of smoking-related products to encompass various items:

- Nicotine Replacement Products: Such as patches and chewing gum.

- Vaping: Even non-nicotine-based vaping.

- Chewing Tobacco

- Cigars

- Pipes

All these nicotine-related products are considered in the risk evaluation process, leading to adjusted insurance premiums for individuals using them.

The table provided above presents a comparison of life insurance costs for smokers and non-smokers, highlighting the contrast between the two. The premiums displayed are for a 25-year term of £200,000 Life Insurance and do not take into account any pre-existing medical conditions.

Average cost of cover with pre existing health conditions

Securing life insurance with a pre-existing medical condition can be a bit more challenging and potentially frustrating, especially if you lack guidance from a specialist.

Determining the average cost of life insurance while grappling with a pre-existing medical condition is a complex task. Several key factors influence your premiums, and it’s essential to take the following into account:

- The nature of your medical condition (acute or chronic).

- The severity of your medical condition.

- The date of your diagnosis.

- The intensity of your symptoms.

- Any history of surgical procedures or treatments.

- The frequency and severity of your symptoms or episodes.

- The presence of any other related medical conditions.

Pinpointing an exact average cost for life insurance with a pre-existing medical condition is exceedingly tricky due to the amount of variables. Each individual’s situation is highly unique, and your circumstances will be distinct to you.

Here are some common pre-existing medical conditions and how they can affect the average cost of life insurance:

Diabetes: The type (e.g., Type 1 or Type 2), recent HbA1c (blood glucose) readings, and any complications (e.g., retinopathy, neuropathy, or nephropathy) will be considered.

Cancer: Factors include the tumor level (grade and stage), the type of treatment received (e.g., radiotherapy, chemotherapy, or surgical removal), and whether the cancer has spread to other areas.

Overweight: Your Body Mass Index (BMI), calculated from your age, height, and weight, is a key factor, along with any related complications such as cholesterol or blood pressure.

These are just a few examples of pre-existing medical conditions and how life insurance underwriters might evaluate them. The vast number of variables makes it incredibly challenging to determine an average cost. If you would like an accurate quote with free advice click down below and one of our advisors would be more than happy to help.

Let Us Help You Protect Your Family

Cover your loved ones from as little as £6* a month

No Comments