12 Apr Whole of Life Policy: What You Need to Know Before You Buy

Whole of Life Policy: What You Need to Know Before You Buy

- Has no expiry date on the policy.

- Can guarantee a pay out.

- Usually used to cover funeral costs.

- Provides peace of mind.

What is a whole of life policy?

A whole of life policy is a type of life insurance that provides coverage for the entirety of a person’s life, rather than a set term. This means that as long as the policyholder pays their premiums, they will have coverage until they pass away. However, these policies can also be more expensive than term life insurance and may not be necessary for everyone. It’s important to carefully consider your needs and options before purchasing a whole of life policy.

Whole of life policies can provide peace of mind, knowing that loved ones will be taken care of financially after the policyholder passes away. Many people use this policy to cover funeral expenses however, some may use it to leave something behind for their loved ones as it guarantees a pay out.

The difference between whole of life and term insurance

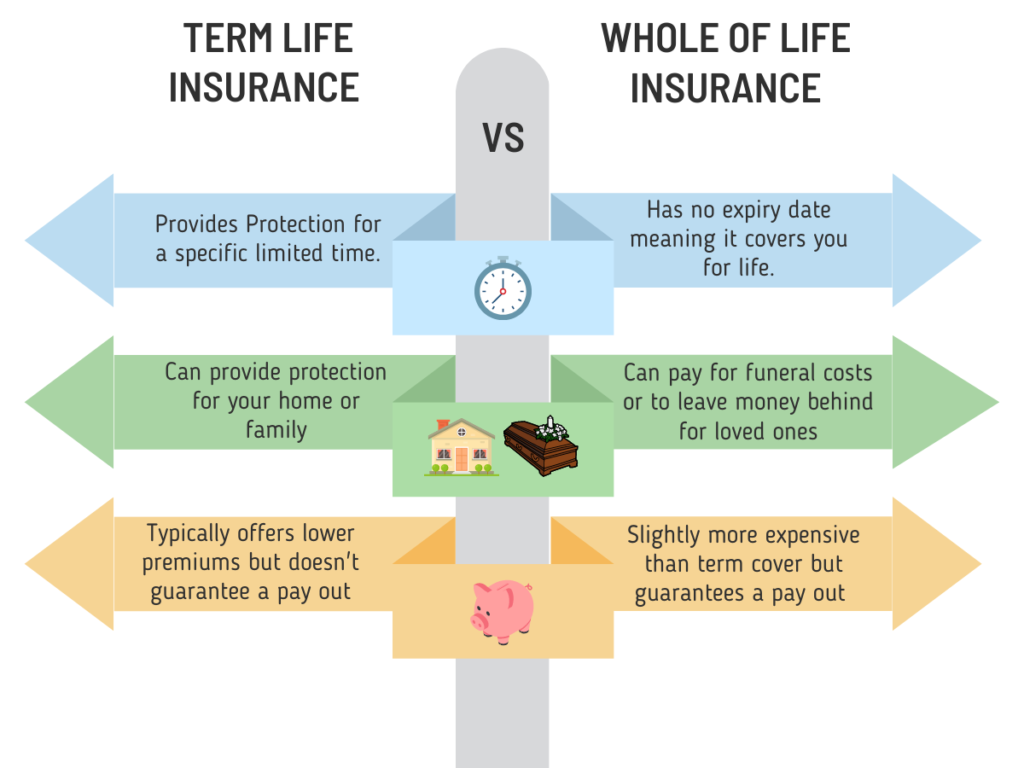

Here’s a simple breakdown of the key differences between term life insurance and whole life insurance:

Duration: Term life insurance covers you for a specific number of years, while whole life insurance lasts your entire life.

Cost: Whole life insurance can be more expensive compared to term life insurance with the same payout because it guarantees a payout whenever you pass away, unlike term insurance, which only pays if you pass away during the insured period.

Cash Value: Some whole life policies can come with a cash value component that you can access, withdraw, or borrow against while you’re still alive. Term life insurance doesn’t offer this feature.

Both types of insurance aim to provide financial security for your loved ones after you’re gone, but they work in different ways.

Drawbacks of a whole of life policy.

While there are many benefits to a whole of life policy, there are also some drawbacks to consider before making a purchase. One of the main drawbacks is the cost – whole of life policies tend to be more expensive than term life policies, as they provide coverage for the entirety of a person’s life.

Another drawback of a whole of life policy is that it may not be necessary for everyone. If you only need coverage for a certain period of time, such as until your children are grown or until you pay off your mortgage, a term life policy may be a more cost-effective option. Additionally, whole of life policies may have complex terms and conditions, making them difficult to understand for the average person. It’s important to thoroughly review the policy and consult with an adviser before making a decision. We can help you get the cover that is correct for your situation.

What determines the cost of whole of life cover?

Age

Benefit Amount

Smoker Status

Medical History

Understanding the costs and fees associated with a whole of life policy.

The price of your whole life insurance policy can be influenced by various factors, such as your age, height, weight, health status, occupation (especially if it’s a high-risk job), and whether you smoke.

However, the most significant factor impacting the cost of your policy is usually the coverage amount you select. Because whole life insurance guarantees a payout throughout your entire lifetime, it tends to be one of the more expensive forms of protection.

Does whole of life insurance expire?

No, a whole life policy has no expiration date.

A whole life policy is exactly what its name suggests – it’s designed to endure throughout the policyholder’s entire life, with no expiration. There’s one rare exception: some providers may offer a payout when you reach the age of 100.

So, as long as you keep up with your premium payments without any interruptions, your policy will remain active, safeguarding you for the entirety of your life.

Can I get whole of life insurance if I’m in poor health?

Good news – even if you have pre-existing health conditions or are not in the best shape, you can still secure a whole life insurance policy. Yes, it’s possible! Just be aware, while it’s accessible, it might cost you a bit more in premiums, and there could be certain conditions attached to the cover.

Depending on your age and individual situation, you may want to consider the over-50s guaranteed acceptance life cover. As the name implies, this policy is tailored for individuals over the age of 50 and stands out because it doesn’t require a medical evaluation. Every applicant, regardless of their health conditions, is approved for this coverage.

Let Us Help protect your loved ones financailly

Cover from as little as £6* a month

No Comments