31 Jul UK Mortgage Protection

UK Mortgage Protection

- UK Mortgage protection pays your mortgage in full if you pass away.

- Mortgage protections ensures that the debt won’t fall to your next of kin.

- Mortgage protection insurance starting from £5* a month

- Tailored protection to meet your needs.

UK Mortgage Protection

UK Mortgage protection insurance is meant to pay off your mortgage fully if you die during the policy’s term.

Your mortgage is probably one of the biggest debts you’ll ever have, and most people take a long time to pay it off. But what if you die before you pay it back in full? Could your family pay the mortgage payments every month? Your family home could be in danger if you don’t have any insurance.

In this guide, we’ll cover everything you need to know about UK mortgage protection insurance, including how it works, what it covers, and how to choose the right policy for your needs.

What is UK mortgage protection?

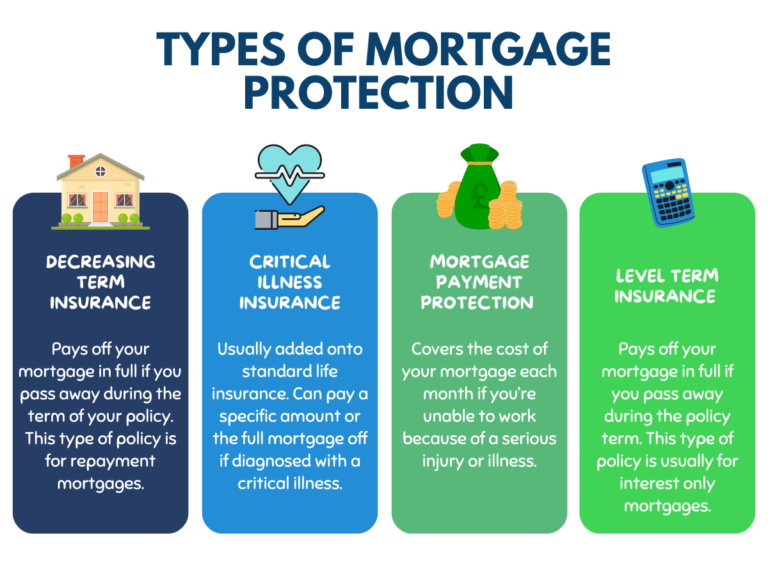

UK mortgage life protection is a type of insurance that pays off your mortgage in the event of your death. This means that your loved ones won’t have to worry about making mortgage payments after you’re gone. It’s important to note that mortgage life insurance protection is different from mortgage payment protection, which covers your mortgage payments if you’re unable to work due to illness or injury.

There are a few ways that you are able to protect your mortgage in the UK. Life insurance is only one of the ways you can protect your home. Critical illness protection is something you can add onto your standard life insurance to make it more comprehensive. This will pay a part of your mortgage or the mortgage in full, if you are diagnosed with a critical illness.

How to choose the right UK mortgage protection.

Choosing the right UK mortgage protection can be a daunting task, but it’s important to carefully consider your options to ensure you have the right coverage for your needs. It is always best to get professional advice when trying to figure out exactly what you need in place. We always strive to make sure that you are protected adequately but also making sure that your protection is still affordable.

We would firstly figure out the type of mortgage you have (repayment or interest only). This would give us a better understanding of what type of cover you need in place. We would also ask you a few questions to assess your financial situation to determine if any other cover would provide you with added protection.

Critical illness insurance would provide you with comprehensive cover as it would pay out if you were diagnosed with a critical illness that is on the terms of your policy. However, as much as we would recommend critical illness to everyone it is an expensive protection product so we would only recommended it if it is suitable for your budget.

Know How Much Coverage You Need

It can be tricky when choosing how much cover you need and also how long you would need it for. Your mortgage insurance should always match the remaining amount left to pay off and however long the mortgage term is. This would ensure that if anything were to happen to you during the mortgage term it would be paid off in full. This would mean that your next of kin and loved ones wouldn’t need to worry about the mortgage payments as it would be fully paid off.

It is crucial to get financial protection advice from a protection expert who can assist you in determining the proper amount of coverage for your unique circumstances. With our assistance, you will feel confident that you are adequately protecting yourself and your loved ones. We always make sure to thoroughly explain life insurance advice. This is because when we recommend a certain policy, we want you to understand why the policy is a good fit for you.

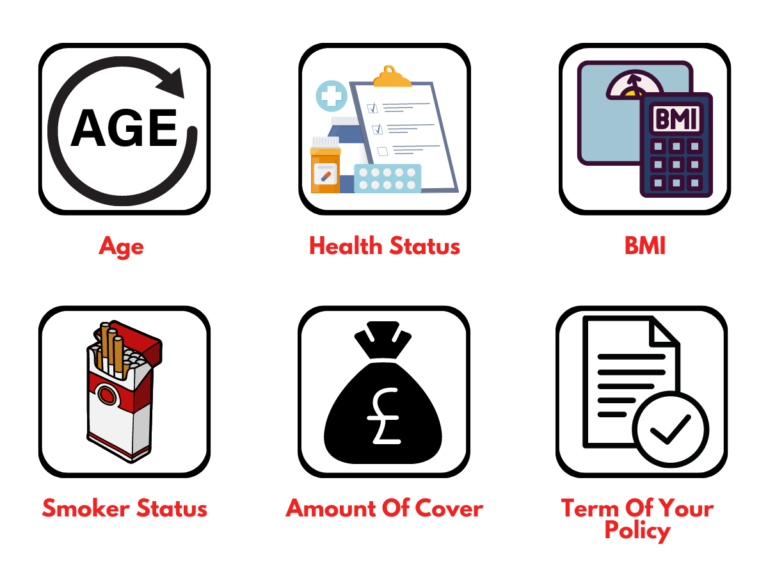

What determines the cost of Uk Mortgage protection insurance?

Age

Term

Lifestyle

Sum assured

Smoker Status

Medical History

Understanding What Affects UK Mortgage Protection Insurance

When it comes to mortgage financial protection, the two most essential elements that decide your premium are your age and health. In general, the younger you are when you get a policy, the lower your premium. This is because younger people are often healthier and less prone to developing health problems that would increase their insurer’s risk. So, if you’re thinking about getting mortgage insurance, it’s recommended to buy it sooner rather than later to lock in a reduced cost.

Be Truthful When Applying

When applying for mortgage life insurance, it is critical to be completely honest and upfront about your personal details. Even if you fear that sharing a certain detail may harm your prospects of acceptance or premium rates, you must do so. Because insurance companies have ways of checking the information you supply, any inaccuracies may result in the cancellation or denial of your policy. When applying for UK mortgage protection life insurance, remember to always be upfront and truthful.

When searching for life insurance, keep in mind that the insurer will collect information about you in order to calculate your risk level. This information may include medical information, prescription drug history, and general lifestyle questions. It is critical to be honest and upfront during this process in order to acquire correct coverage and avoid future complications. Your family will not receive benefits if you lied on your insurance application. If you have any medical issues, please notify our experts, and they will do their utmost to assist you in finding insurance.

Why shouldn't I Focus On Price?

It is important that you select a life insurance coverage that falls within your budget. However, do not make the mistake of focusing entirely on the price. Consider the amount of coverage, the length of the policy, and the reputation of the insurance company. All of the insurance companies who we work with are Defaqto 5-star rated. Furthermore, it is good to evaluate your policy on a regular basis to ensure that it continues to fulfil your needs and to make any necessary changes. At Carew & Co, we call our clients on an annual basis to confirm that their policy is still appropriate for their circumstances and to advise them on any adjustments that may be required.

Our advice is always free of charge, and we make sure that the insurance you have in place adequately covers you. That is why we call you once a year to go through all of your policies. Even if your circumstances have changed, we can assist you in finding the best coverage and offer free advice.

Let Us Help You Protect Your Income

Cover your family from as little as £6* a month

No Comments