07 Dec Why You Need Mortgage Protection Life Cover

Why You Need Mortgage Protection Life Insurance

- Sagar Joshi

- 07/12/2022

- Read Time: 3 Minutes

What is mortgage protection cover?

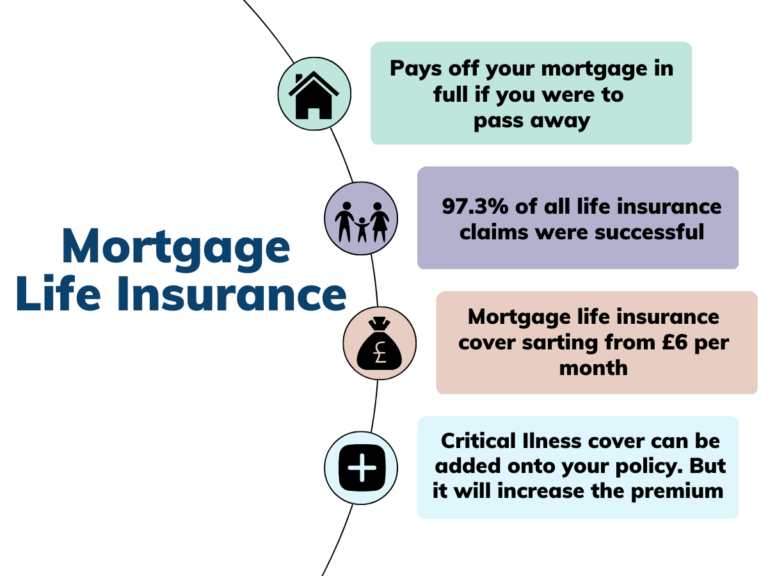

Mortgage protection cover ensures that if the policyholder passes away, the pay out covers the mortgage in full. This means that the debt would not fall to your next of kin and your family could continue living in the house without worrying about mortgage payments.

Mortgage payments are one of the largest expenses faced by individuals. Therefore, it is essential to consider how you would pay your mortgage if you or your spouse were to pass away.

Why mortgage protection life insurance is useful

If you currently have a mortgage or are looking to get one, then mortgage protection life insurance can be very useful. If your family relies on you financially and you pass away without any mortgage life insurance, your family may struggle to continue paying off the mortgage. This could result in them having to move to an alternative home.

However, if you were to have the correct life insurance in place that matches the amount and term left on your mortgage, Your mortgage would be paid off in full, meaning your family wouldn’t have to worry about the financial struggle if you were to pass away. Your mortgage insurance should be your priority when it comes to your financial protection, as you wouldn’t want the mortgage to fall on your next of kin.

How much cover do I need?

When taking out your policy you must ensure that the mortgage balance is covered by your mortgage life insurance policy. Due to this, the amount of coverage will vary for each individual.

It is essential to keep in mind that if you move or remortgage, you’ll need to ensure that you have the right protection in place. Otherwise, you could have one of the following outcomes:

- A payout that doesn’t cover your mortgage in full.

- A policy that either exceeds or falls short of your mortgage term.

- Overpaying for cover that you may not even require.

How much does mortgage protection life insurance cost?

The cost of this type of insurance is determined by a few factors:

- Your Age

- Your health and medical history

- Lifestyle factors such as your smoker status

- Mortgage amount owed and the term of your mortgage.

The cost of mortgage protection for each individual will vary as everyone’s situation is different. However, mortgage protection life insurance starts from £5* a month. To get your quote click down below and one of our advisors will give you fee-free advice.

Critical illness cover with mortgage protection

Critical illness coverage provides a lump-sum payout that’s used to pay off all or part of your mortgage if you’re diagnosed with one of the severe illnesses listed on the policy terms. The removal of this financial burden allows you to heal with less pressure to return to work.

Many insurance providers offer critical illness insurance as a policy addition if you want further protection.

Here are some examples of what Critical Illness Covers:

- Certain types and stages of cancer

- Stroke

- Heart attack

- Multiple Sclerosis

- Permanent loss of vision / hearing

- Loss of limbs

- Motor Neurone Disease

- Organ failure / transplant.

No Comments